Last month we used two of our handy products, SalesData and LibraryData, to get the sales and borrowing data for the books that Canadians are buying in the first half of 2019 and the books they're borrowing from libraries. We thought it would also be interesting to turn to our Canadian Book Consumer study (our quarterly surveying of Canadian, English-speaking adult book buyers) and bring you some of the highlights for the first half of 2019. Read on to see what formats and subjects Canadians are purchasing, where they're buying, and more.

Book formats purchased by Canadians

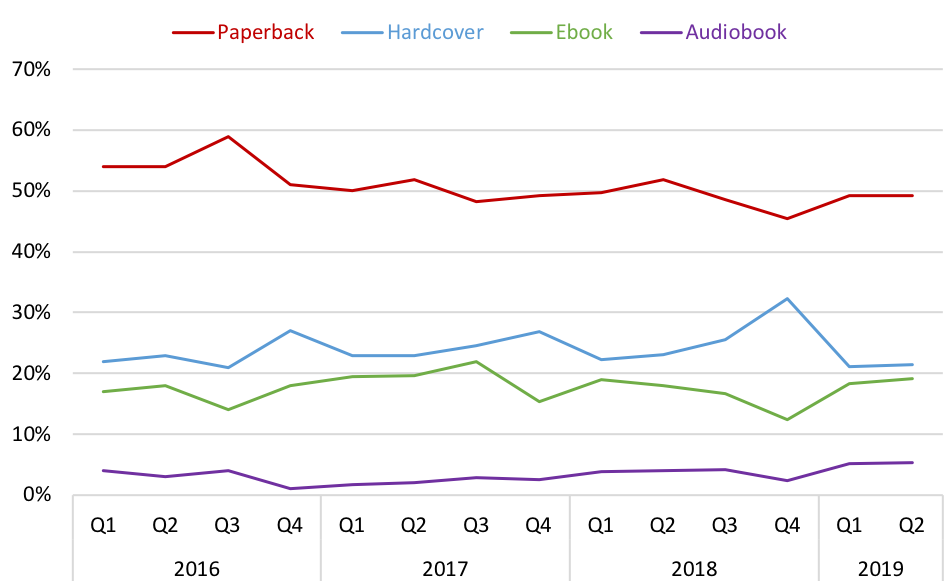

Print purchases make up about three quarters of all purchases (combining paperback and hardcover). Digital books (ebook and audiobook combined) account for the remaining 24% of all purchases in 2019 so far.

Formats purchased from 2016 to mid-year 2019

Audiobooks continue to see a steady increase; their share of purchases increased to a little more than 5% in the first half of 2019 compared to less than 2% in the first half of 2017 and less than 4% in the first half of 2018.

Ebook purchases, accounting for approximately 18% of book purchases so far in 2019, generally peaks in the first two quarters of the year. Hardcovers (21% of purchases in 2019 so far) are down slightly from the same period in both 2018 and 2017. Paperback purchases, accounting for approximately 50% of all book purchases in the first half of 2019, has remained roughly the same for the comparable period in previous years.

Where Canadians are buying their books

We categorized retail channels into online and in-person channels. Online represents purchases made from websites, ebook/audiobook downloads, and mobile apps. In-person represents purchases from chain bookstores, independent bookstores, general retailers, discount stores, grocery stores, and book clubs.

Where buyers bought books from 2016 to mid-year 2019

Since 2016, online purchases have been trending slightly upwards and in-person purchases have been trending slightly downwards (see the dashed lines in the above graph). In the first half of 2019, in-person and online purchases were even at 50% each, which bucks the trend observed in previous years.

What subjects are Canadians buying the most?

Here are the top five subjects purchased by Canadian book buyers in the first six months of 2019:

Adult Fiction and Young Adult Fiction:

Suspense and Thrillers

Fantasy

Mystery/Detective

General

Romance

Adult Non-Fiction and Young Adult Non-Fiction:

Biography & Autobiography

Health & Fitness/Diet

Religion

True Crime

Computers

The top two subjects purchased within the Juvenile category (excluding Young Adult books) were picture books and fiction/reading.

More facts about Canadian book buyers for the first six months of 2019:

Their most popular book-related online searches are for books by Canadians or local authors, or about Canada and local subjects.

They primarily read (or plan to read) their digital books on e-readers, followed by smartphones. For reference, the most-owned devices among book buyers are desktop/laptop computers and smartphones. Dedicated e-readers are the least-owned devices.

The number of book buyers who belong to a book club or reading group has grown. In the first six months of 2019, approximately 14% of buyers told us that they are a member of a book club or reading group; this is more than double the number for the first six months of 2018.

The 14% of book buyers who are members of a book club or reading group have bought a lot of books so far in 2019: an average of 3.6 books a month. In comparison, non-members purchase only 2.9 books a month.

65% of book buyers are members of a book-based loyalty program.

Further reports on consumer buying habits, sales trends, digital publishing, and more can be found at booknetcanada.ca/bnc-research.

The BISAC to Thema translator has been updated.